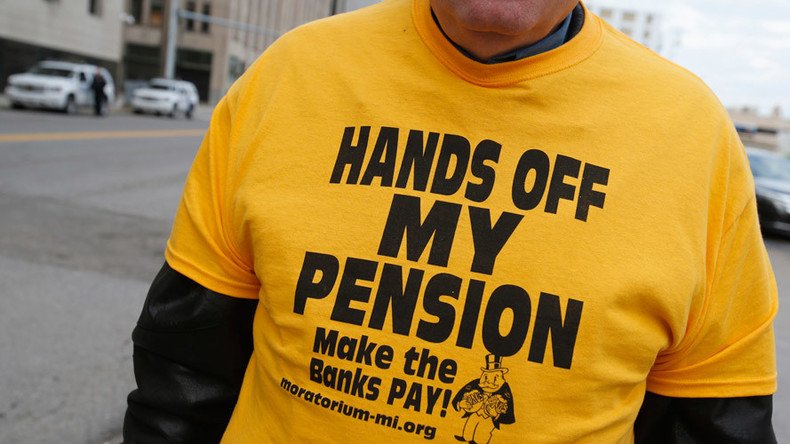

How America’s top corporations are stealing $376bn (and counting) from their workers

The S&P 500's largest corporate pension funds are stealing a staggering $376 billion from their workers by underfunding their pension funds, new figures from Citibank reveal.

The top 25 of these plans accounted for $225bn of that underfunding.

World’s biggest pension fund hit by $52bn loss https://t.co/OAd6Y4CJbz

— RT (@RT_com) August 26, 2016

Citigroup’s Chief US Equity Strategist Tobias Levkovich warned, “Pension under-funding continues to be a major issue for S&P 500 constituents as very respectable equity market gains over the last seven years have not substantially alleviated pension pressures.”

New figures from #CitiGroup show S&P 500 corporate pensions underfunded by over $376bn pic.twitter.com/FhXONC0Aca

— Colm McGlinchey (@ColmMcGlinchey) August 23, 2016

“Major issue” is something of an understatement as the S&P 500 corporate pensions have been underfunded since before the start of the Great Recession, hitting $376bn last year, a 22% increase from the 2008 level of $308bn.

READ MORE: Legendary Playboy mansion sold to son of union-busting billionaire (VIDEO)

The oil crash, and not corporate greed, is to blame, according to Citigroup, claiming decreased prices hurt a wide range of industries and personal income (not to mention some national economies).

Energy workers have the most to worry about as the capital-intensive industry was the least-funded sector despite the billions of dollars in profit.

Legacy companies like General Electric, General Motors and Boeing lead the table in underfunding almost 700,000 current employees, partly because they have to pay for the golden retirement plans for their executives such as Jack Welch.

@linaolight@Peacepox Jack Welch took what 300 million$ in retirement,then went after the gov on bogus employment numbers,GE sham company

— PeePartyexpress (@PeePartyExpress) October 6, 2015

Top 25 S&P 500 underfunded companies pic.twitter.com/nq9XfNadDB

— Colm McGlinchey (@ColmMcGlinchey) August 24, 2016

Only 30 companies in the S&P 500 were fully funded as of year end 2015, with almost half of the overfunded companies coming from the financial sector.

Desperate for fund yields, South Carolina and Hawaii have turned to the risky business of selling puts, a tactic eerily reminiscent of those used in the run-up to the financial crisis.

Using puts, a contract is sold by the investor to the owner of a stock offering security on the investment.

If the stock falls below a given price, the put guarantees the investor will either buy the declining stock or cover the loss in value.

Great article about problems the South Carolina pension is facing | https://t.co/jPLqtXNVhb#scnews#sctweetspic.twitter.com/vXK6LsNdb7

— Curtis Loftis (@TreasurerLoftis) August 22, 2016

This gives pension funds regular income and is considered a low-risk tactic as funds are set aside to cushion the blow of any payouts.

The contract cost increases as market swings are expected, relying on buyers overpaying for insurance.

Where it becomes a huge risk is when an unexpected downturn occurs leaving pensions in South Carolina and Hawaii exposed to huge losses.

This would echo to last decade when credit default swaps were sold on mortgage-backed securities, a bet once considered a sure thing.

History has told us different.

“There comes a point where you might be picking up pennies in front of a steamroller,” Nathan Faber, vice president of investment strategies at Newfound Research, warned in the WSJ.

If pension underfunding continues in the same alarming direction, funds will need to be found eventually, whether through bailout or massive benefit cuts, both likely to be at the cost of the taxpayer.

READ MORE: Dutch pensioners invest in Amsterdam’s red-light district