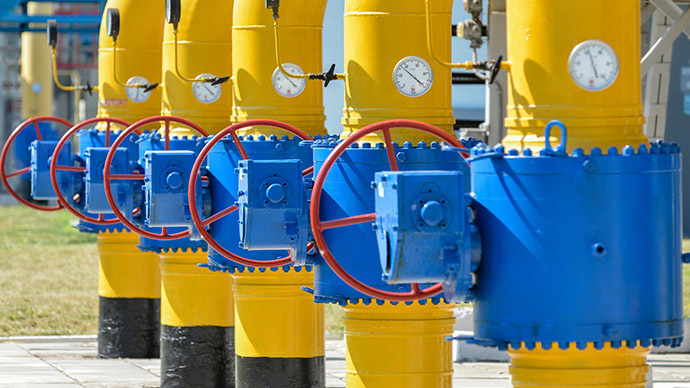

Debt-ridden Ukraine buys 1 bcm of Russian gas as winter gains force

Gazprom has confirmed that Ukraine's gas importer, Naftogaz, has paid $378 million for 1 billion cubic meters of Russian gas for December delivery, as Kiev starts to feel the winter frost.

“On December 5, Naftogaz Ukrainy transferred to Gazprom 378 million U.S. dollars as advance payment for one billion cubic metres of gas,” Gazprom’s representative Sergey Kupriyanov said, TASS reported.

On Friday, Naftogaz released a statement that they had completed the prepayment, and expected the gas to start to flow Monday. Ukraine, on the brink of economic collapse, is experiencing a full-on energy crisis, and has now turned to Russia gas and even coal. The war in the east has prevented Kiev access to the country's vast coal supply.

“Naftogaz Ukraine has transferred $378 million to [Russia's energy giant] Gazprom in prepayment for deliveries of 1 billion cubic meters of gas," a statement released late on Friday said.

In June, after Ukrainian energy giant had failed to pay a $5.3 billion gas debt accumulated over months of getting fuel from Russia, Gazprom switched to a prepayment system. Kiev was refusing to pay the price under a standing contract, saying it was too high.

The volatile situation intensified fears among EU consumers of Russian gas that Ukraine would exploit its position of a transit country and start siphoning off the pipeline in the winter months.

In late October, Ukraine, Russia and the European Union reached an interim agreement to ensure Ukraine's gas supply until March 2015. According to the deal, Kiev must pay Russia a total of $3.1 billion by the end of 2014 in order to cover part of its outstanding debt that Kiev acknowledges as rightful. In early November, Naftogaz transferred the first $1.45 billion tranche.

According to the October deal, dubbed the 'Winter Plan', Russia must restart the flow to Ukraine within 48 hours of receiving prepayment.

READ MORE: Russia, Ukraine agree on gas supplies until March 2015

With the start of the winter season in late October, Ukraine's gas reserved have depleted by 17 percent falling to 13.9 billion cubic meters as of December 1, according to data from Ukrtransgaz, Naftogaz’s transport subsidiary. Ukraine’s national gas corporation is in a financial tight spot at the moment. The company's deficit is some 52 percent larger than that of Ukraine itself, the country’s PM warned on Wednesday.

“I’m worried more about Naftogaz’s deficit, which is larger than the overall deficit of [Ukraine’s] national budget. The state budget today is 68 billion hryvnas ($4.4 billion), and the deficit of Naftogaz, which we financed because the tariffs didn’t correspond with the market price for gas, is 103 billion hryvnas ($6.7 billion),” Arseny Yatsenyuk said.

But the two budgets are not as separated as one might think. For instance, the $1.45 billion payment to Gazprom in November to cover the gas debt was footed by the Ukrainian central bank. This payment was one of the reasons why Ukraine's national currency reserves dropped by $2.62 billion to $9.97 billion that month, according to the latest report.

Naftogaz budgetary problems are to a large degree result of its obligation to supply gas to some consumers regardless of whether they pay for it or not and at a lower than market price. Ukraine has been allowing this for years as a de facto form of government aid to poorer people and some industrial consumers.

In September, an IMF report said that Ukraine's plans to overcome Naftogaz’s deficit by 2018 will be difficult. To achieve this Naftogaz, according to Kiev's calculations, has to have a debt of no more than 4.3 percent of GDP in 2014 and 1.9 percent in 2015. But IMF calculations, point to a negative dynamic with company's deficit amounting to 10 percent GDP by the end of 2014.

Getting a hold on the budget deficit – both within the government and key state-owned companies like Naftogaz – is a requirement IMF put forward to allow further loans to Ukraine. It also demanded a hike in utility prices, which the Yatsenyuk government is currently putting into place. The measures are causing understandable irritation among the Ukrainian population, who are not thrilled to see their bills skyrocket amid an economic slowdown plaguing the country.