US proud to rip off Gaddafi

Before the Arab world uprising spread to Libya, the country was a top international investor with an impressive portfolio with one of the biggest US banks. Today the fund is virtually empty and there is little remorse among the American bankers.

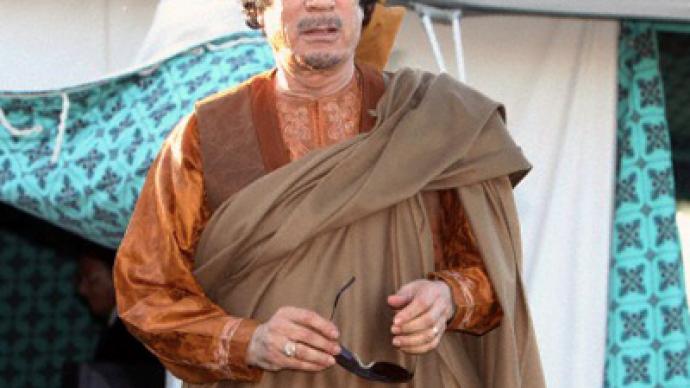

Long before the US-led air strikes against Libya’s Muammar Gaddafi, the dictator and one of America’s most profitable banks were firm financial friends in 2008. According to the Wall Street Journal, Goldman Sachs offered Gaddafi the chance of becoming a huge shareholder. But only after losing 98 per cent of Libya’s $1.3 billion sovereign-wealth fund in just a few months.“They lost a staggering percentage. I do not know how you lose 98 per cent of something. It was a bet on options on European banks and energy companies whose stocks plunged shortly thereafter. But in any case, clearly they saw a goldmine in Gaddafi,” said Russ Backer, an investigative journalist.When the fund, controlled by Colonel Gaddafi, nearly emptied, Goldman ponied up offers to recoup losses. According to the journal, Libya would get $5 billion worth of Goldman shares – in return for making a $3.7 billion investment in the securities firm. Libya agreed to buy the bank’s debt, but with a promise of a lucrative annual 6 per cent return for 20 years.“Goldman knew it was about to head into a nosedive and there they were selling Libyans a piece of junk, which was themselves,” stated Greg Palast, an investigative journalist. Libyan sovereign-wealth fund officials are reportedly accusing Goldman of misrepresenting investment deals and making trades without proper authorization. But others proudly admit playing fast and loose with Gaddafi’s money. American real estate and reality-show tycoon Donald Trump boasts that he lied to and deceived the Libyan leader in the past.“I rented him a piece of land. He paid me more for one night than the land was worth for a year or two years, and then I didn't let him use the land. That's what we should be doing. I don't want to use the word 'screwed', but I screwed him,” boasted Donald Trump. Now, critics say, the Libyan people stand to get screwed by Wall Street.“Trump’s comments were very interesting in terms of the attitude that American executives and American officials have towards other countries. They are there to be screwed and Trump said it publicly, advocating it as a policy and having done it personally,” explained Danny Schechter, a journalist.Due to frozen assets and financial sanctions imposed by the US, Europe and the United Nations, Libya’s sovereign-wealth fund could arguably be forgotten about. Unless one of the world’s top official firms is held accountable.“Americans have been demanding that for years without any success. Can Gaddafi achieve what the American people and American government cannot or won’t achieve? I don’t think so. I think they’re going to get away with this big billion dollar boondoggle with Libya, just as they’ve done it with America,” maintained Schechter. Goldman Sachs is currently being investigated for playing a major role in the 2008 financial crisis – a crisis that cost millions of Americans their jobs, homes and life savings. While a military conflict currently divides the US and Libya, uniting citizens of both countries is the financial gain Wall Street has made at their expense.