India’s gold imports surge as rupee plummets to record low against US dollar

Imports of gold to India surged for the first time in seven months after jewelers refilled stocks, taking advantage of sliding gold prices and rising demand with an upcoming jewelry exhibition.

According to provisional data from metals consultancy GFMS, India’s gold purchases in July soared by 44.2 percent to 75 tons against the same period a year ago. The upsurge may bolster global prices, which plunged to a 17-month low earlier this week.

However, growing gold imports by the world’s second-biggest buyer of the precious metal might increase India’s trade deficit and turn up the heat on the country’s weakening national currency. On Monday, the rupee declined to a record low of 69.89 against the US dollar.

“The recent rise in imports was due to stock building due to lower prices ahead of the jewelry show and in anticipation that the rupee may continue to weaken until [it reaches] 71 rupees,” GFMS analyst Cameron Alexander told Reuters.

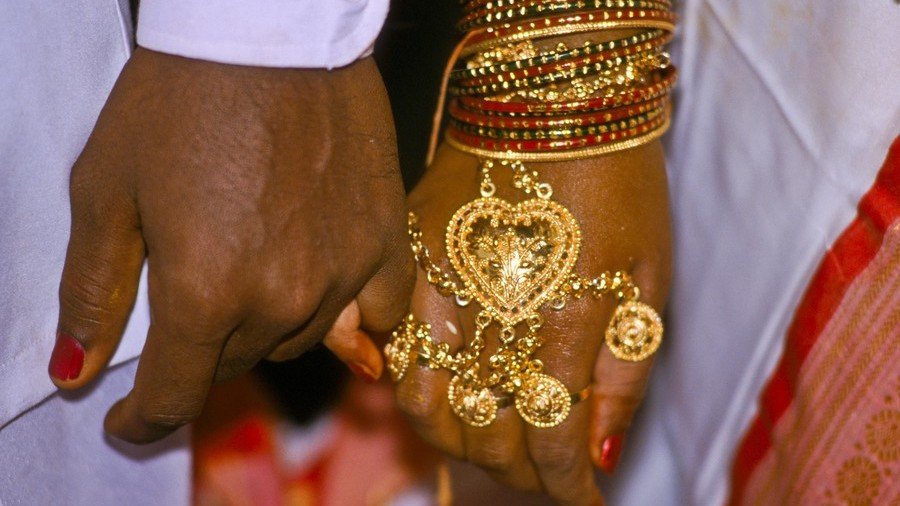

The India International Jewelry Show, which that opened last week in the Mumbai-based Bombay Exhibition Centre – reportedly attracted 1,300 exhibitors along with 40,000 visitors from more than 80 countries. The exhibition helps jewelers to showcase their designs to international and domestic buyers.

“Jewelers were not buying in June [as they were] expecting a big drop. In July, the correction attracted jewelers, who were on the sidelines,” said a Mumbai-based dealer with a private bullion importing bank, as quoted by the agency.

In July, Indian gold prices fell to their lowest level in six months.The data from GFMS shows that the country’s gold imports for the first seven months of the current year dropped 28 percent to 406.2 tons compared to the same period a year ago.

'Buy crypto and gold. Your USD will become worthless' - @KimDotcomhttps://t.co/k9OvWUGx50

— RT (@RT_com) 13 августа 2018 г.

According to data released by the World Gold Council earlier this month, Indian gold demand will improve in the second half of 2018 after falling six percent in the January-to-June period. The changes will reportedly come amid government reforms that are aimed at boosting farmers' incomes and increasing rural buying power.

In August, imports are expected to remain robust due to the upcoming peak of the festival season, according to Mukesh Kothari, director at Mumbai-based bullion dealer RiddiSiddhi Bullions. The fourth quarter of the year usually sees strong demand for gold because of the wedding season and festivals such as Diwali and Dussehra.

For more stories on economy & finance visit RT's business section