China cuts back on US debt for 5th month in a row

China, the largest holder of US debt, has continued to cut back on US Treasuries for the fifth consecutive month, shaving $5.2 billion from its holdings between December and January. Japan is edging closer in overtaking the number one spot.

The US Treasury reported Monday that China reduced its holding from $1.244 trillion in December to $1.239 trillion in January. The fifth straight month of reductions.

Economic growth in China, which is at a 25-year low, is the most obvious explanation for the scale back. With more capital leaving mainland China, the less the government needs US dollars to keep the yuan in check.

In total, foreign central banks sold off $12.3 billion in US Treasuries in January, the fourth consecutive month of outflow.

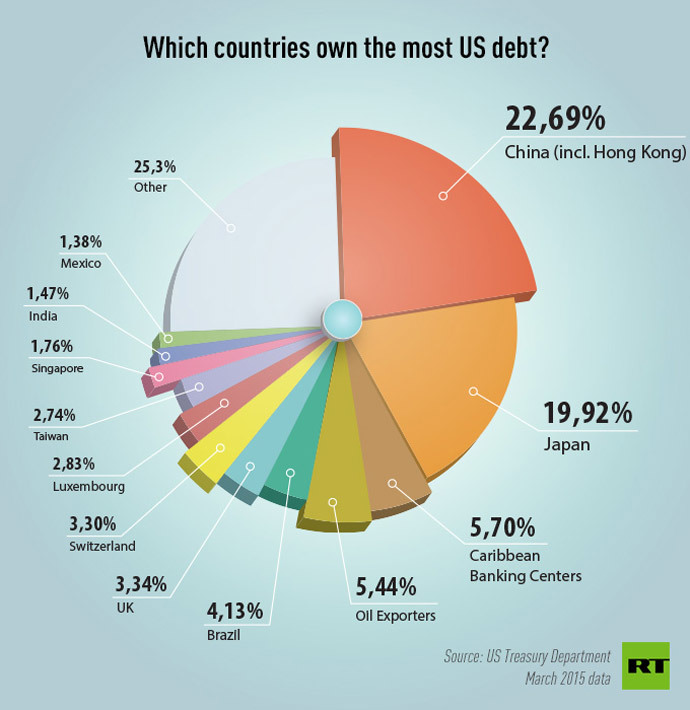

Despite China’s pull out, overall foreign holdings increased one percent to $6.22 trillion, or just over 34 percent of total public debt. Among all foreign creditors, China and Japan own about 40 percent of US Treasuries.

Japan, the second biggest US debt owner, upped its holdings by $7.7 billion to $1.2386 trillion. Now Japan is neck-and-neck with China as the largest foreign holder of US Treasuries. HSBC Holdings forecast Japanese investors may buy up $300 billion in US Treasuries in the next two or three years.

As the Japanese yen continues to weaken under the Bank of Japan’s monetary stimulus, the demand for dollar-held assets is increasing.

READ MORE: US blows through $18trn debt limit

“Japan should be on the path, from a Treasury perspective, to becoming a much bigger holder just because of what’s going on in their market and because they’re the kinds of investors that would invest across different markets,” Aaron Kohli, an interest-rate strategist at BNP Paribas in New York, told Bloomberg News.

Belgium, the third largest owner after China and Japan, increased its share to $354.6 billion, a $19.6 billion increase since December.

US debt is becoming a safer more attractive option compared to Europe, where near-zero interest rates and stimulus plans threaten to stifle bond yields.

While Europe pursues a loose monetary policy, the US is getting ready to tighten with an expected interest rate rise this year.