When Saudi Arabia takes a bone saw to US shale industry, we may see oil at $10 a barrel

While the world was looking the other way at the Covid-19 pandemic, Saudi Arabia used the diversion to flood the oil market and push the US shale industry’s head under. It’s now going to hold it there until the twitching stops.

Every country requires highly functioning energy markets to ensure its survival as well as to foster economic stability, which enables organic growth in productivity. Unfortunately, since mid-February, all of the global financial and energy markets have been rocked by unprecedented volatility.

Since 1953, the US has been a net importer of oil. As such, the US has been subjected to global supply disruptions caused by geopolitical and economic events beyond its control in the Middle East.

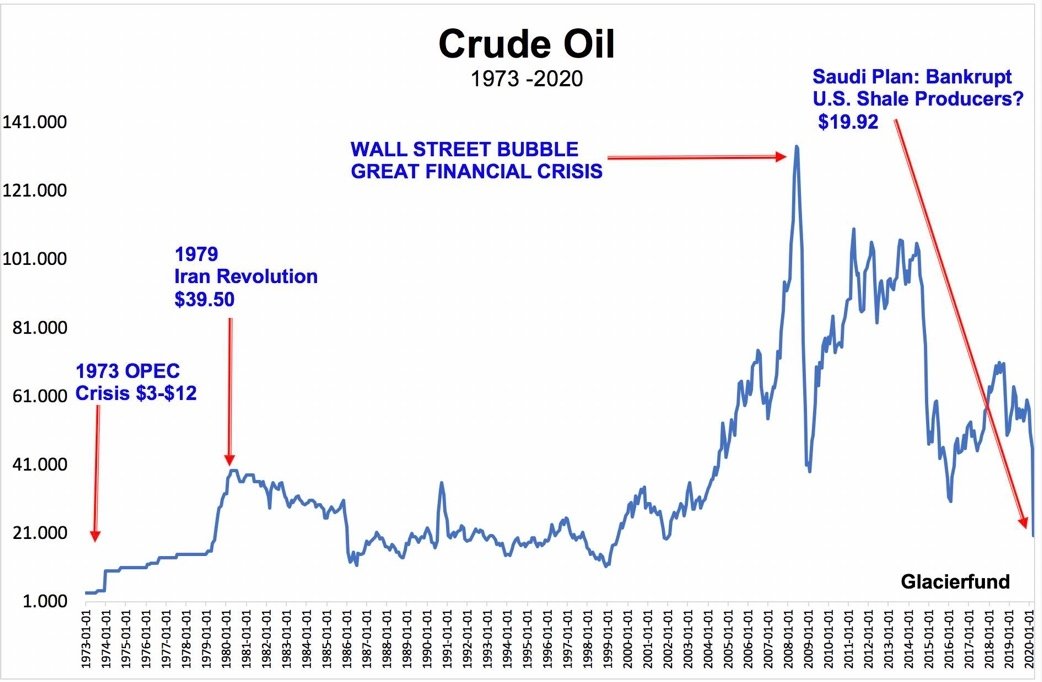

The first oil crisis was in 1973 when the Organization of Arab Petroleum Exporting Countries (OAPEC) proclaimed an embargo on US oil exports, breaking the supply chain and resulting in severe shortages, rationing, and long lines to buy gasoline across America. Prices skyrocketed 400 percent from $3 a barrel to $12 a barrel.

The second crisis was in 1979. Iran’s revolution was blamed for the four percent decline in global oil production between Iran and Saudi Arabia, producing oil shortages in the US. Once again, this caused a break in the supply chain and prices shot to $39.50 per barrel over the next year.

The third crisis was during the lead up to the Great Financial Crisis, when the media made rumblings about eurozone debt and discord in the Middle East. Wall Street investment bankers used these factors to push Brent crude oil up to an intraday record high of $147.50 per barrel. West Texas Intermediate (WTI) crude oil, in the chart above, topped out at around $133 per barrel. When the GFC hit, demand collapsed, the oil bubble popped, and prices plummeted below $40 per barrel.

The US was determined to protect itself against these geopolitical shocks and the savage oil-price spikes that could thrust an already frail world economy back into intensive care or, much worse, into a global economic depression. As a result, the US has pursued an aggressive policy of achieving energy independence over the last decade. Since then, the US substantially increased its production of shale oil, coal and natural gas.

The problem with this shale boom was extreme leverage and massive debt that needed to be created in order to fund these pork-barrel shale projects. Investment bankers’ models forecast that a robust recovery would quickly see oil prices back at $80-$100 per barrel. Junk bonds, using leverage, were sold, but when the projects were finished the yields on many of the sites came in much lower than expected, and oil prices dipped below the breakeven profit levels, causing loan modifications, some defaults and some bankruptcies.

Fast forward to 2020, a disagreement between the Organization of the Petroleum Exporting Countries + Russia (OPEC+) members would soon expose the price vulnerabilities inherent in the over-leveraged US shale business. OPEC+ members could not reach an agreement on production cuts, so the oil flowed, and prices dropped to below $20 per barrel – a record one-day 30 percent collapse in oil prices.

Just spoke to my friend MBS (Crown Prince) of Saudi Arabia, who spoke with President Putin of Russia, & I expect & hope that they will be cutting back approximately 10 Million Barrels, and maybe substantially more which, if it happens, will be GREAT for the oil & gas industry!

— Donald J. Trump (@realDonaldTrump) April 2, 2020

Even if the Saudis agreed to an OPEC+ deal on production rates, it would aim to keep oil prices in the low 30s or lower in an effort to explode the over-leveraged US shale bubble. Many investors believe that Saudi Arabia was waiting for a strategic opportunity, such as a recession, before pushing prices lower and making the highly leveraged US shale producers vulnerable and force them into bankruptcy.

Why did the Saudis want to do this? The US reportedly produced a new record high of 12.23 million barrels of crude per day in 2019. That’s billions of dollars that provide Saudi Arabia with billions of reasons to bankrupt the US’ shale business. Less competition means more money in Saudi pockets.

Then Covid-19 gave the Saudis the recession they’ve been waiting for.

My bet: oil prices are staying in the $20 range or lower until the US’ over-leveraged shale industry goes bust – could this be the next trillion-dollar US government bailout? Or will this begin of the nationalization of the US oil shale business?

Think your friends would be interested? Share this story!

The statements, views and opinions expressed in this column are solely those of the author and do not necessarily represent those of RT.