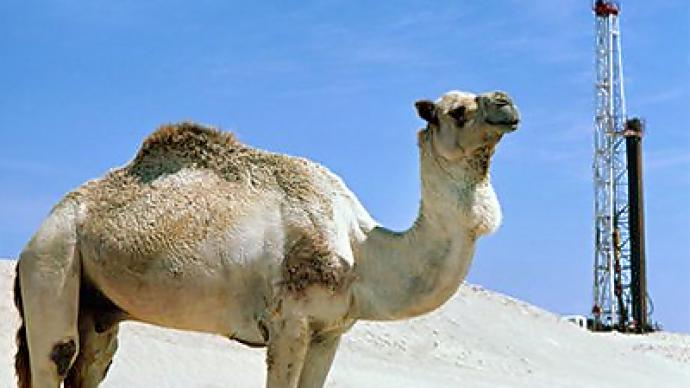

The short term impact of the oil price surge

With crude prices hitting highs on the back of concerns about Libyan supply being blocked by prolonged civil disputes, Business RT spoke with Vladimir Rozhankovsky, Head of research at Nord Capital, about the implications for Russia.

RT:How concerned are you that higher oil prices will knock the global economic recovery off course?VR:“One word, been there done that.We know judging by the experience of 2008 that the deteriorative effect will take place.However, it’s not going to happen overnight.It will take approximately 4-6 months for the detrimental economic impact to happen. During this time, obviously, investment in the energy resources will stay attractive.However, what is good for Russia is not so good for German, so to say, we know this saying, right? Therefore, right now, right now the question is how long this euphoria will last. I don’t think it will last, obviously, for Russia.It is not going to last for more than 3 or 4 months.Right now obviously there is going to be inflow of foreign funds, positive trading balance, there is going to be zero deficit of the budget, and obviously will cause more consumption, more luxury cars on the streets, more exotic travelling.However it is not going to last for a year – I am absolutely confident in that.”RT:Do you think it's time for investors to act defensively and if so, how could they do that?VR:“Well in the meantime, as I said, there is no ground for panic, because detrimental things will not happen immediately.So far, so good.We can still invest in stocks moderately.We need to be careful stock picking.Debt market looks relatively stable.The energy and commodities does a big paying definitely, so we need to weigh exactly, for how long we are going to invest in oil.During this Arab conflict, obviously it is a good way to invest in oil.However if the conflict will ultimately untie, one day, and we wake up in the morning and see prices going back to, let’s say, $80 by WTI, then obviously we will be caught by surprise.We don’t need that, therefore the horizon is very limited.I would say right now, all investment media is available, but I would say has significantly shrunk.” RT:Do you agree with Vladimir Putin that sharply higher oil prices are not good for Russia?VR:“Absolutely.In the short run it will be good for Russia.As I said, it will cause influx of foreign funds.There will be boosted consumer confidence, boosted spending, but Russia unfortunately cannot sustain itself by itself.So the economy is also dependent on the Foreign investment, in other words the global economy will have problems.”