Gold, silver plunge after Trump names Fed chair pick

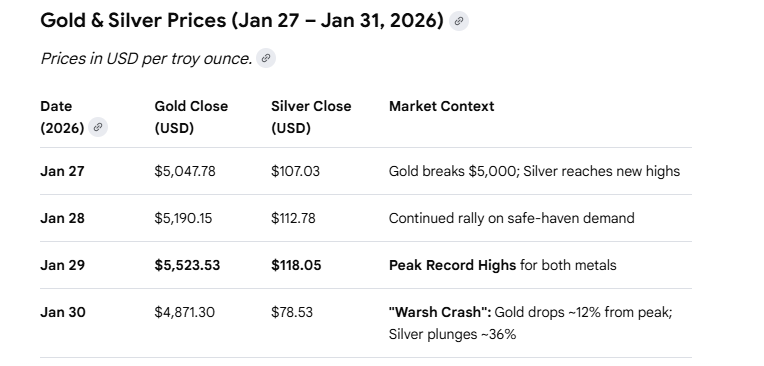

Gold and silver prices plunged on Friday in one of their worst single-day declines in years after US President Donald Trump named former Federal Reserve governor Kevin Warsh to lead the central bank.

Gold fell 12% from its January 29 peak of roughly $5,600 per ounce to around $4,800, marking its steepest one-day loss in more than a decade, although it is still up about 65% year-on-year. Silver, which had far outpaced gold’s gains over the past year, sank more than 30% to under $80 an ounce, its worst drop since 1980. The rout wiped out more than $7.4 trillion from gold and silver prices in 24 hours, roughly equivalent to a quarter of the US economy.

Both metals had recently surged on fears the Fed could lose its independence and be forced to hold rates artificially low to help finance government debt. Analysts say Friday’s selloff was triggered after Trump – who repeatedly attacked Fed chair Jerome Powell for refusing to cut rates – named Warsh as the next Fed chair.

Although Warsh was previously hawkish on interest rates, echoing Powell’s concerns that premature cuts could stoke inflation, he has recently shifted tone, saying Trump was “right to be frustrated” by the slow pace of rate cuts.

While there is still uncertainty over how Warsh would steer policy – and with his nomination pending Senate confirmation – analysts say the pick stripped out the “inflation panic” premium from the precious-metals rally, as markets took it as a signal the Fed would remain independent and prioritize price stability over political pressure.

Analysts also said the announcement triggered a long-overdue correction, with months of uninterrupted gains leaving both metals technically overbought and elevated prices offering traders an attractive exit, amplifying selling once sentiment turned.

Despite the sharp pullback, many forecasts for safe-haven assets remain bullish, with analysts saying the core drivers of the 2025 rally – geopolitical tensions, persistent inflation risks, trade frictions tied to Trump’s tariff policies, and the expanding US debt burden – remain intact.

The rally ahead of Friday’s crash gave Russia major windfall gains, with gold holdings up more than $216 billion – nearly matching the $300 billion in sovereign assets frozen in the West. Analysts at JPMorgan and Goldman Sachs say central banks may view the current correction as an opportunity to further increase bullion reserves at lower prices.