Oil prices won’t recover above $100 – Russian Finance Ministry

Decreasing oil prices are “inevitable” and the chance they will exceed $100 per barrel is “unlikely” the Russia’s Finance Ministry said. However, the Russian budget can withstand lower prices.

“The market is biased in favor of excess supplies. That is why price reduction is inevitable; it will have a structural character. We are unlikely to see prices higher than $100 per barrel in the near future,” Maksim Oreshkin, the head of the Russian Finance Ministry's strategic planning department told RBC TV in an interview.

“In general, the current downward price movement is structural. Investments in oil production have increased dramatically in the past ten years,” Oreshkin said.

Russian officials have stressed there will be no sharp rise in Russia’s budget deficit, but the country's largest bank, Sberbank, says an oil price of $104 is required to balance the 2015 budget. A drop of prices to $80 per barrel could cost Russia 2 percent of GDP.

The weak ruble will be a buffer to lower oil prices, since costs are in rubles, but revenue in dollars.

“The ruble is down which allows Russia to maneuver a bit by making some extra cash from oil sales, since those are done in dollars,” RT correspondent Egor Piskunov reported from Moscow.

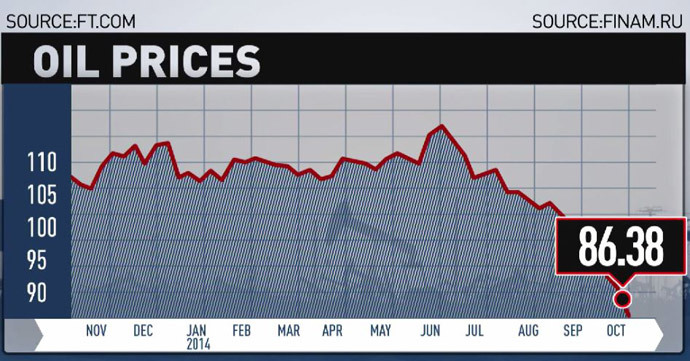

The Russian state budget is based on oil prices of $96 per barrel, which both Brent and WTI crude fell below in previous days.

Last week prices hit a 4-year low, with Brent futures reaching a critical point of $84 per barrel. Just months ago, at the height of the Iraq turmoil, Brent was trading at $116 per barrel. WTI crude, the main North American blend, hit a four-year low dropping below $80 Thursday. Both blends have been falling for the last four months.

Prices plunged further after the International Energy Agency (IEA) cut its forecast for world oil demand this year by 250,000 barrels.

There are several stress factors on the low prices; from supply, to ISIS, to the US shale boom.

$80 per barrel oil prices is not profitable for any oil exporting country, but political factors may weigh higher than economic.

“There has been some talk that this involves Saudi Arabia. What we know is the price of producing the oil in a lot of places in the Middle East can often be around $80 per barrel or higher,” Patrick Young, Executive Director of DV Advisors told RT.

Saudi Arabia, which has enough money in its budget to keep oil prices around $80 per barrel for a few years, may be willing to sell oil at a loss to put pressure on ISIS, according to Young.

“ISIS has to sell their oil at a discount to the world price. If ISIS are being pushed to $60-70 per barrel, that actually means in the long-term, they cannot produce oil very profitability in wells they control in parts of Syria and Iraq,” Young told RT.

Saudi Arabia is a member of Organization of the Petroleum Exporting Countries (OPEC), which has seen a surge in supply since September, especially with the reemergence of Libyan oil on the market.

“OPEC, an organization which is like a club of major oil producers, is refusing to decrease production, which could fix the situation and increase the price of oil - we’ve seen OPEC do it before,” Piskunov said.

Piskunov warns of the massive negative impact the tactic could trigger on the wider economy.

“Global markets depend on oil prices. Instability with oil can lead to instability or even chaos on the markets,” Piskunov said.

Fracking factor

Another factor that will come into play in the next 6 months is shale oil in the US, which Oreshkin believes will “drop dramatically” as drilling will become less profitable. US shale projects become unprofitable when the price of oil hits $80 per barrel, according to Oreshkin and American energy officials.

The shale boom in the US could be curbed by low prices, as the payoff decreases with every dollar knocked off the barrel price.

“They will only drill if the market prices ensure profitability of the project,” Oreshkin said, adding that as a result investment in new projects will decrease.

“One of the elements of shale drilling is that a well loses about 50 percent of its production capacity in the first year. This means that production drops dramatically. To maintain production levels, let alone to increase them, more drilling is essential,” he said.

The US shale boom, which began in 2008 and has increased US crude output by 60 percent, is another element in the oil price rout. The IEA said North American shale will only remain profitable above $80 a barrel.